If You’re Not Buying Gold and Silver – Don’t Blame Me!

Mark J. Lundeen Mlundeen2@Comcast.net 03 January 2013

Read it and weep all you “respectable” investment advisors and “financial journalists”; gold has finished its twelfth up year since the stock market top in January 2000, with silver finishing its tenth up year of the past twelve. To see the actual significance of gold and silver’s performance since December 1999, the table below lists the performance of gold and silver with the Dow Jones Total Market Groups (DJTMG) and some key economic statistics. And remember, for over a year the metals have seen a cyclical correction while the stock market has been “advancing”, as the “policy makers” stand guard against deflating financial assets.

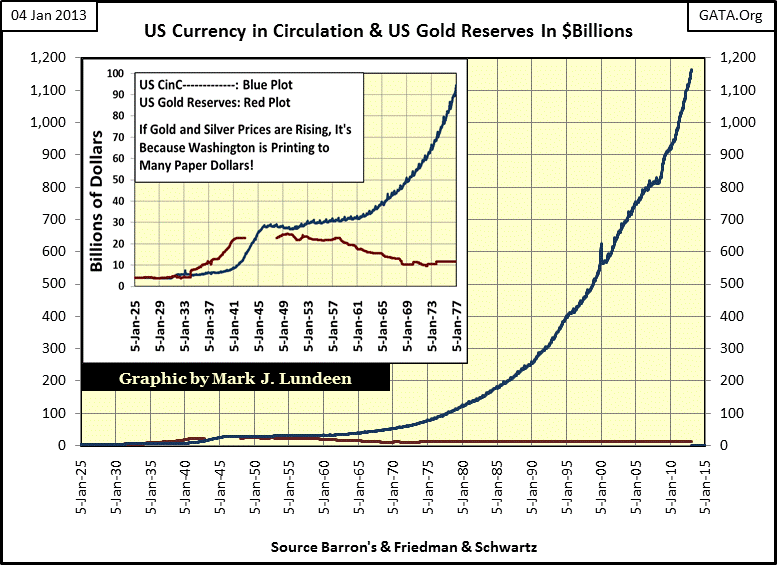

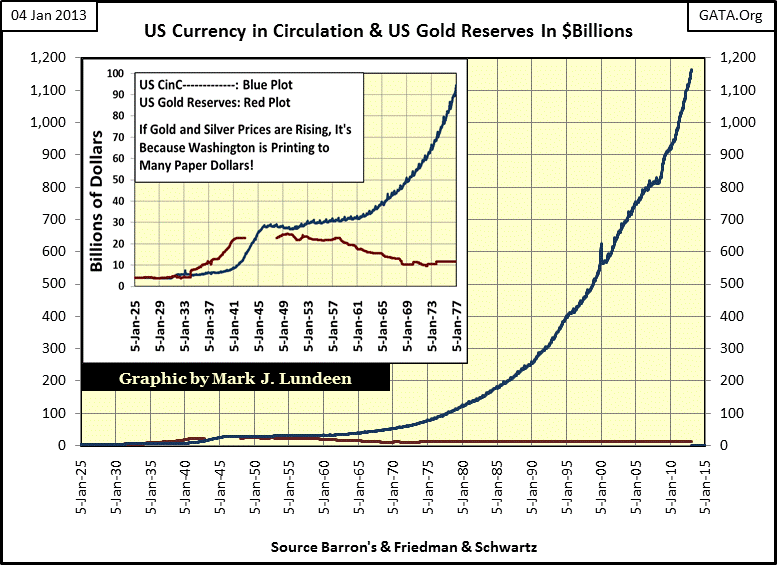

I use Currency-in-Circulation (CinC #41); the number of US Dollars printed and placed into circulation by the US Government as my inflation index. It’s not perfect, but far superior to the US Department of Labor’s Consumer’s Price Index (CPI #63). However, noting that the US National Debt (#22) is up 185.47% in the past twelve years, maybe I should begin using the increasing rate of flow for toxic waste emitted from the US Treasury as my inflation index. No matter, gold and silver sit comfortably at #2&3 in the table, far above the increases in CinC and the National Debt. This is important to all of us; seeing gold and silver appreciating faster than the frauds, wastes, and fiscal abuses of the Federal Government.

Note that every item numerically above Digital Hardware (#72) has seen a negative return in nominal dollar terms since December 1999. However, anything above CinC (#41) up to Digital Hardware may have seen a positive twelve year nominal gain, but has performed below the rate of inflation as measured by CinC. Still, Washington will tax you for your nominal gains (inflationary losses) all the same.

In truth, the financial media for the past thirteen years has had positive and negative things to say about every investment item listed in the table. Well they have. But on the whole, it is fair saying the financial media for over a decade has biased their reporting in support of the winning investments of the 1990s’, with most of them found between #73 & #100 with nominal double-digit percentage losses.

If gold, silver and mining shares have done so well since 1999, why is investment sentiment so poor for what is clearly the best performing asset class of the past decade? Media coverage of precious metals for over a decade has been of two varieties:

- Promoting precious metals when metal prices were near cyclical peaks, with the effect of luring uninformed investors to enter a market in danger of a normal short-term bull market correction.

- Speaking nothing but ill of the old monetary metals when they were correcting in price, suggesting that the precious metals bull market, the financial media has yet to acknowledge, was finally over.

Just this week on Wednesday morning (Jan 02), Dennis Gartman on CNBC once again warned the public against considering gold as a “safe” investment. Then just hours later, Jim Cramer told his viewers to take a good position in the bank stocks as 2013 is looking up as a good year for the banks. If gold, silver and yes the mining shares too have done wonderfully since December 1999, most people investing in them have not done well due to intentional media disinformation. This is a real shame for aging Americans will discover in a few years that Washington has comingled their Social Security payroll “contributions” with the Federal government’s general-revenue funds.

But one can’t simply look at dry percentages shown in the table above to fully comprehend the impact CNBC “experts” have had on its viewers’ net worth. So I based the table below on the performance of $10,000 invested in December 1999 to December 2012. Ten thousand dollars invested in gold, compared to the returns of the DJTMG’s Banking Index.

Here is how I calculated the results; $10,000 could purchase 34.8068 ounces of gold in December 1999 (today $10K buys only 6.055 ounces), the banking index values are as published in Barron’s.

34.8068 Ounce of Gold @ $1,651.5 = $57,483.47 – DJTMG Banking Index performance (-$3,550.17) = $53,933.30 Difference in Return.

A return difference of $53,933.30 between the appreciation of $10K of gold since 1999 and the depreciation suffered by investing $10K in bank stocks; that’s huge! You can be sure this will not be commented on by the financial media, but it’s true nonetheless.

But we should recognize that things change; today’s heroes have a way of becoming tomorrow’s zeros. Gold and silver have been in a bull market for over a decade; how long can this last? In the years to come I expect gold and silver, and yes even the greatly despised gold and silver mining shares, will continue rising to price levels that are simply not believable today. Here is why.

We all know that the Doctor Strangelove of perverse monetary science, Doctor Bernanke, will continue “injecting” the supply of US dollars in global circulation until our planet upchucks Obama bucks. And it’s not only the United States that is determined to make its unit of trade worthless; all other central banks are doing the same with their national units of account. Expect future demand for honest money (the old monetary metals), to be tremendous and global in scope.

That alone should be sufficient reason reject Wall Street’s “investment recommendations” and buy as much gold and silver as one can afford. However, there are some interesting developments at the COMEX’s futures paper markets that suggest the smart play is to bias one’s portfolio into silver.

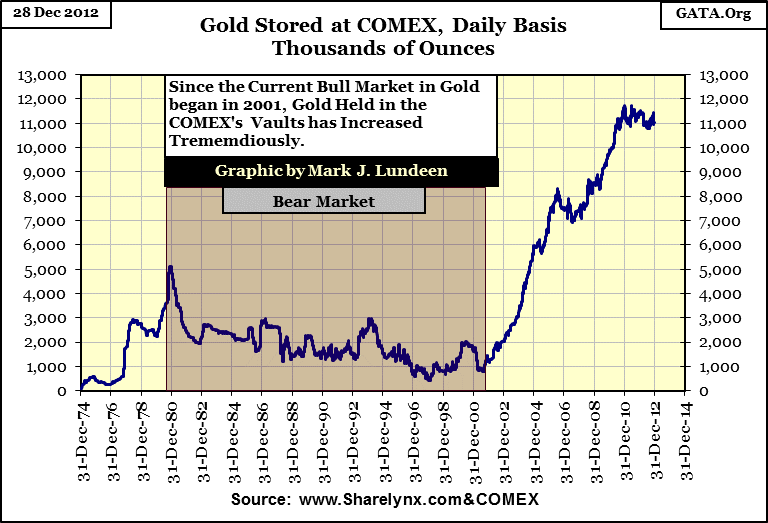

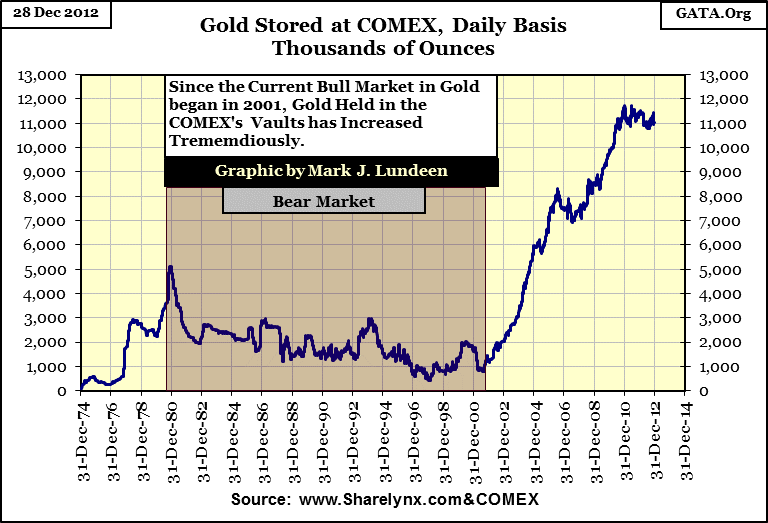

Below we see the weight of gold held at COMEX storage facilities from 1974 to present. COMEX being a gold market needs gold on hand for delivery, should delivery be demanded by the buyers of gold in New York. In fact, most of the contracts traded at the COMEX are settled in dollars so to date this has not been an issue – at least so far.

However, China will become a major gold trading center in the next few years, and they are not intimidated by Washington’s “regulators” or the IRS. Should China’s gold & silver exchange allow metal prices to rise higher than the suppressed prices seen daily on the COMEX, in recognition of gold and silver’s true supply and demand fundamentals, it would become profitable for wholesale purchasers of gold and silver to buy and take delivery of their metal in New York, and fly tons of gold & silver to China for sale at higher prices. This is called arbitrage, and arbitrage is a widely used and a totally legal market mechanism that fixes prices on identical items traded in different markets.

An arbitrage trade for gold and silver, if allowed by Washington, could close the COMEX gold and silver market as the COMEX’s metals will at some point be transferred to China at a profit. But laying too heavy a hand on the free movement of gold flowing out of the COMEX vaults would damage the trust and confidence currently held by COMEX’s large traders. There is nothing stopping these large traders of gold and silver from exporting their operations from New York to Shanghai, except the fear of incurring the wrath of Washington, and China’s current policies of restricting the importation of private gold, and its prohibition of exporting gold. China’s policies on cross border traffic of gold and silver would have to change before it affects the COMEX, but things change all the time.

This is speculation on my part, not a prediction. But what isn’t speculation is that US Government’s economic “policy” is controlled by left-leaning social and political scientists who have contempt for free-market prices. These government bureaucrats neither buy nor sell what they regulate, but they believe they have god like powers to intervene into markets via monetary inflation or regulatory fiat for their ill-advised political purposes.

But as “stupid is what stupid does”, Washington will continue to hide the inflationary consequences of its imprudent quantitative easings by attempting to depress the market price of gold and silver via the COMEX’s paper gold and silver market. Ultimately they will fail, and free-market forces will cause gold and silver prices to rise to their actual free market valuation at the COMEX, or cause the precious metal trade to move to greener pastures than the United States at some time in the unknowable future.

The thing to note about the chart above is how the supply of gold in New York increased during our two bull markets, and then decreased during the bear market. Like bikinis or snow shoes for sale in summer and winter, the market increases inventory for an item in demand, and liquidates items from inventory when demand declines. This is exactly what we are seeing in the chart above, and the demand for gold since 2001 (increase in COMEX gold inventory) is amazing. But note that not all gold held at the COMEX is available for purchase, as the COMEX offers a for-fee service, to store gold for individuals. But I wouldn’t trust them.

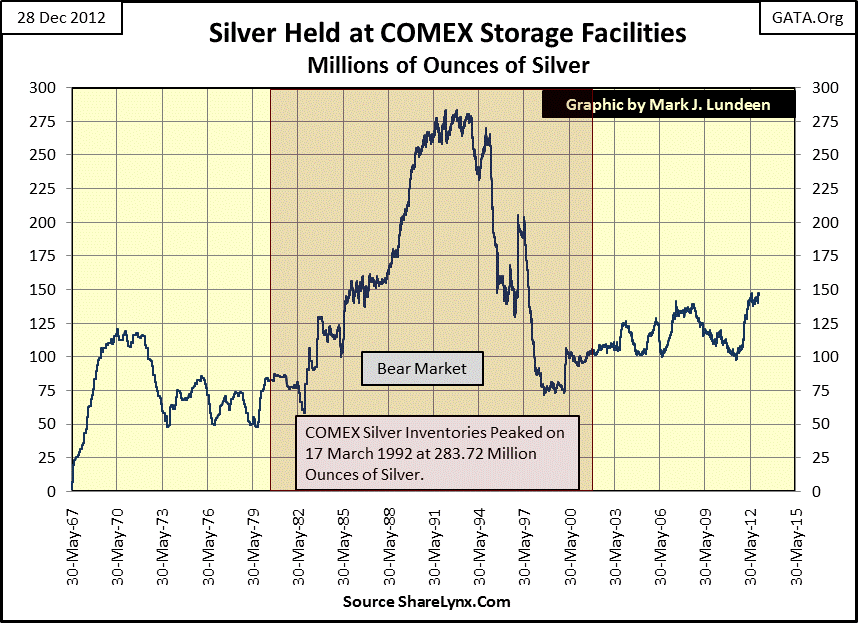

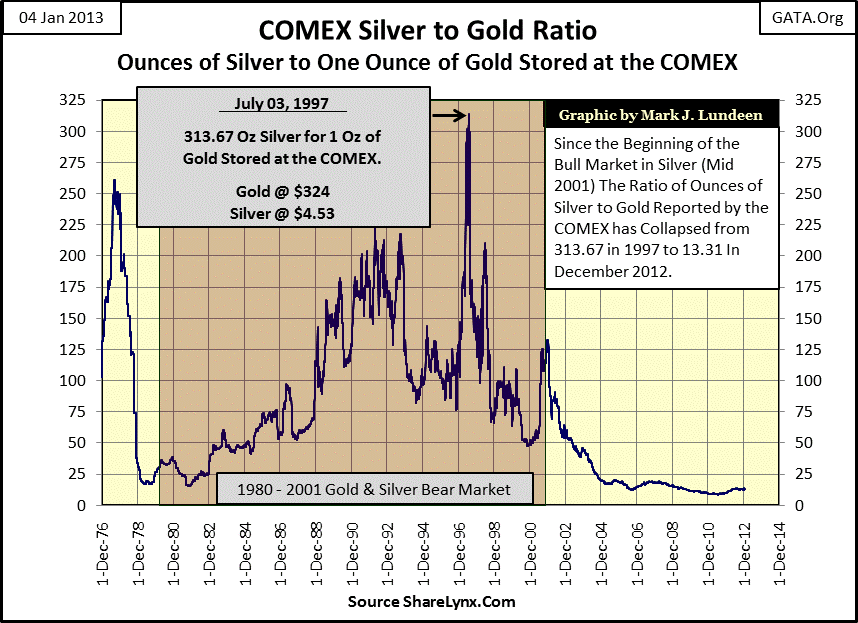

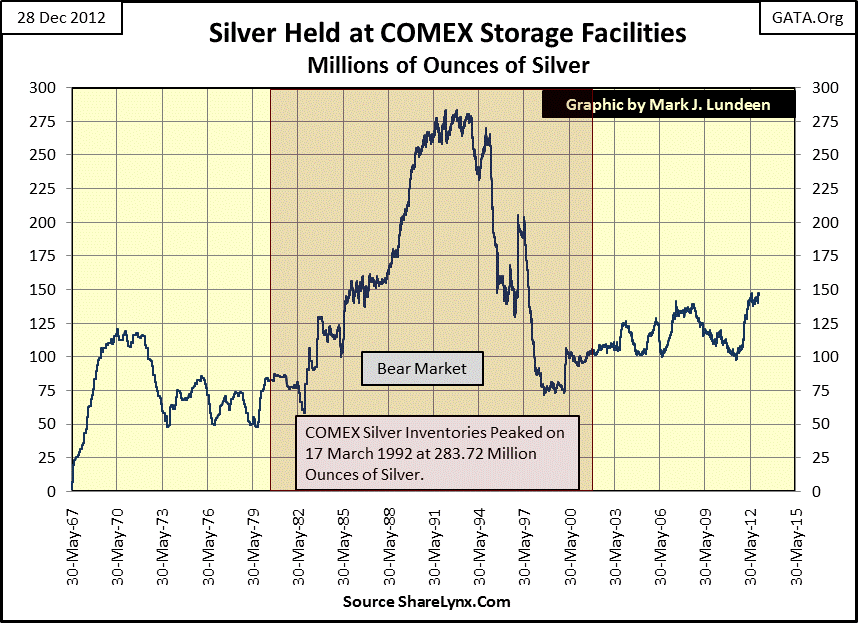

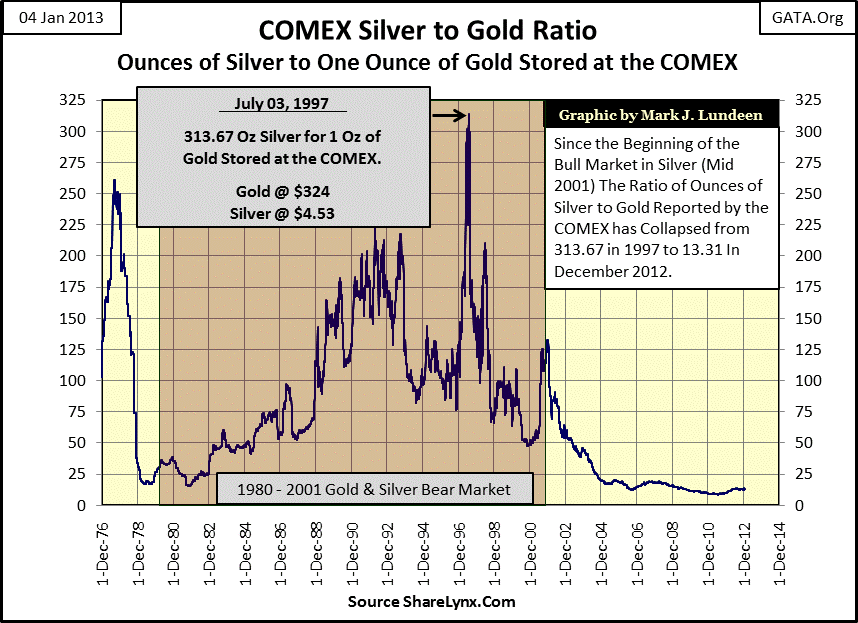

This pattern of increasing inventory during a bull market and declining inventory during a bear market has not been the case at all for the silver stored at the COMEX, as seen below.

During the silver bull market of the 1970s, unlike bikinis during a hot summer, and gold above, the supply of silver went down as demand increased. I know the Hunt brothers were purchasing all the silver they could lay their hands on the 1970s, but why did they choose silver and not gold? Because they got it right. Hunt brothers or not, the supply of silver as far back as the 1960s was in shortage to its demand, and deserved to rise in price to balance available supply to demand. President Johnson on signing his legislation for the removal of silver from US coinage said as much.

“Now, all of you know these changes are necessary for a very simple reason-silver is a scarce material. Our uses of silver are growing as our population and our economy grows. * The hard fact is that silver consumption is now more than double new silver production each year. * So, in the face of this worldwide shortage of silver, and our rapidly growing need for coins, the only really prudent course was to reduce our dependence upon silver for making our coins.”

– President Lyndon Baines Johnson remarks made on signing the Coinage Act on July 23, 1965

But unsaid in this speech was the US establishment’s determination to prevent the price of silver (“a scarce material” as per Johnson) from rising to its true market clearing price since 1965; five decades ago.

This must also be seen in the context of the US Treasury’s demonetizing gold in August 1971. Having the price of gold and silver rising to unbelievable prices from 1971 to 1980, so soon after Washington demonetized their precious metals stored at the US Treasury was a major embarrassment, as the paper dollar and base metal coins were proving not to be as solid a currency as gold and silver coins, demonetized or not, continued to be.

Considering President Johnsons quote above, it’s unlikely the shortage of available silver during the 1970s bull market was due to suppliers of silver withholding supply from a hot market. This reduction in the inventory of silver was due to the inability of the mining industry to supply sufficient silver to the market as demand increased. Now look at the huge surge in COMEX silver after silver peaked in January 1980. COMEX silver inventories increased 225% from 1980 to 1992, peaking at 283 million ounces in March 1992 as the price of silver collapsed 90% from 1980! What is that all about? The collapse in investment demand returned many tons of silver back to the COMEX – but not for long as industrial demand for silver continued to increase. In the silver market, the US government (for decades) has been successful in severing any connection the price of silver has had to its supply and demand fundamentals.

In 1994, during a huge bear market, COMEX silver inventories began draining, but to where? It couldn’t be to satisfy investment demand as silver’s bear market still had seven years to go. Most likely this cheap silver was a gift from Uncle Sam to industrial users of silver. I say this as the US Government during this time was busy selling their huge inventory of silver from its strategic stockpiles. The San Francisco Mint placed an ad in either the SF Chronicle or Examiner’s help wanted pages (I’ve forgotten which) for moving silver in 1994. If I remember correctly, the SF mint was specific enough in their ad to understand they needed workers to move silver to trucks.

In 2002 the US Government announced their five billion ounce inventory of silver was finally exhausted; dumping much of it during a bear market ensured the worst price possible for the US Treasury. Congress could have instead passed this silver directly to the taxpayers, who it actually belonged to, and force the industrial silver consumers purchase it from us at market prices. Doing so would have been a nice windfall profit for the poor, as well as the middle class, but that isn’t what Washington is all about.

We taxpayers may pay taxes, but corporate political donators also give large sums of money directly, but discreetly, to members of congress and to occupants of the White House. And that made all the difference in Washington’s decision on how best to dump billions-of-ounces of silver into the global silver market from 1965 to 2002.

I remind my readers that the inventories of gold and silver charted in this article are those reported daily by the COMEX, and are not global inventories. But then those are the only inventories the COMEX has to operate with. If demand for actual delivery of metal overwhelms the COMEX’s ability to deliver metal some day in the future, it will default.

The government’s “regulators” may declare a force majeure (an “unforeseeable” act of nature), and allow the big banks to settle their silver contracts in US dollars. But what will the banks’ counter-parties call this? A rip-off they won’t soon forget! This would be especially so should the price of silver explode in the spot market on news of the default. I expect the CFTC will declare silver’s dollar settlement price for the COMEXs defaulted contracts at the last COMEX silver price at the announcement of the force majeure.

Well, we all do what we can to save the big banks when they get into trouble, so don’t feel sorry for the COMEX longs should they get paid $50 to $100 dollars an ounce under the spot price of silver after a default. But I guarantee you that the longs will feel sorry for themselves and become bitter-former traders who will never trade metal, and possibility anything else in the US ever again. So a default in the NY gold or silver markets, both tiny compared to the US stock and bond markets, could signal a pending failure of the entire US financial markets due to lack of interest. I’m not saying that the US debt markets will become a “no bid” market. The Federal Reserve is always there to buy what others refuse.

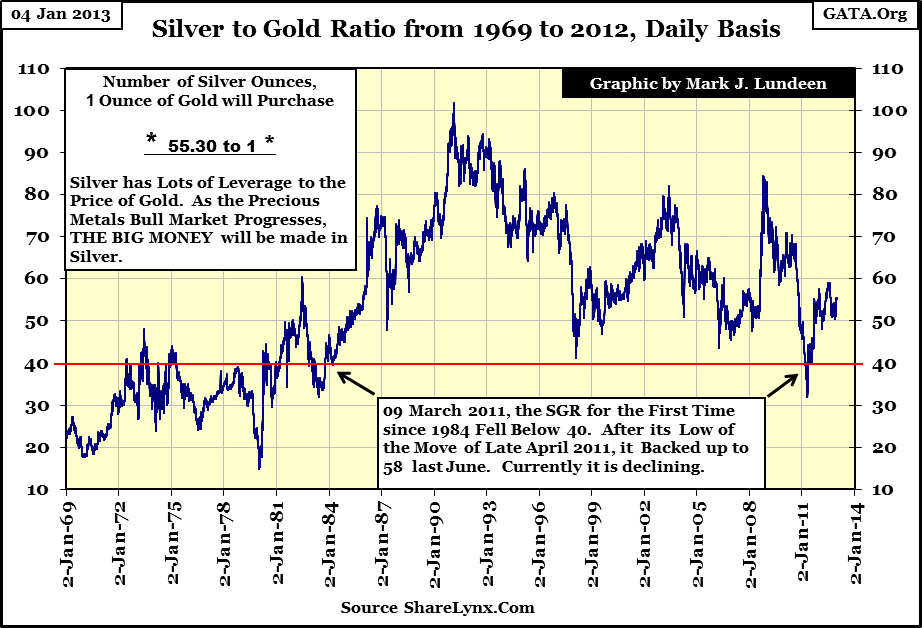

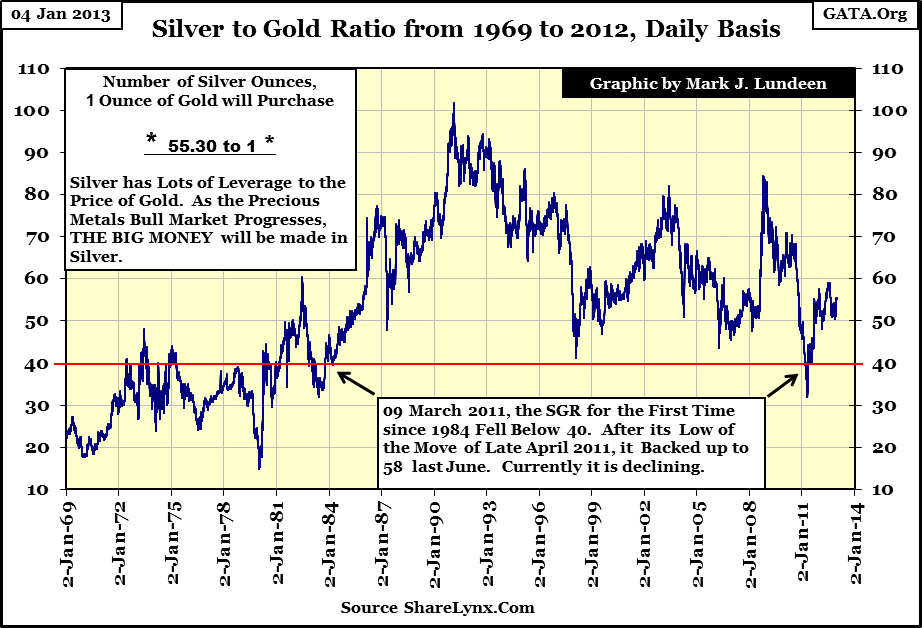

That sounds really bad, but how likely is something like that to happen? Well, if what I’m hearing from Eric Sprott of Sprott Asset Management, and Bill Haynes of CMI Gold and Silver, current precious metals investment demand is buying over 50 ounces of silver for each one ounce of gold purchased. In other words, when retail or large private investors enter the precious metals market, they prudently use 50% of their money to buy gold, and 50% to buy silver. And that is a real problem for the COMEX, and other precious metals wholesale markets, because for political necessity, Washington’s “Wizards of Smart” have seriously underpriced silver to the extent where 55 ounces of silver currently costs as much as 1 ounce of gold.

Why is that a problem? Because the COMEX only has 13.31 ounces of silver available for each ounce of gold in storage.

In other words, demand for silver is consuming global silver inventory at a rate four times faster than gold demand is consuming gold inventories. This assumes that global inventories of silver and gold are similar to the COMEX, and this may not be true. They may have more, but most likely they have fewer ounces of silver than gold available for sale than the COMEX.

Examine the last two charts; since 2001 the Gold Silver Price Ratio (two charts up) has been over 50 ounces of silver to 1 ounce of gold. Assuming that investment demand for precious metals since 2001 has been for gold and silver in equal dollar amounts for metal purchased, a reasonable assumption, silver inventories will soon become critical.

A supply shock in the silver markets could be mitigated if Washington allowed the price of silver to rise, bringing the Silver to Gold* Price Ratio * (currently at plus 55) decline to the COMEX’s Silver to Gold * Inventory Ratio * of 13.3. The price of silver would have to increase by a factor of four ($121.2), or the price of gold would have to decline by 75% ($412) to make this happen. Due to current central bank demand for gold, a 75% decline in the price of gold is just not in the cards. So, I anticipate someday soon see will see silver trading substantially above three digits.

However, matching the Silver to Gold PRICE ratio, to the COMEX’s Silver to Gold INVENTORY ratio cannot be the ultimate solution to the “policymakers’” problem of rising gold and silver prices. How can it be when the real problem is their “policy” of inflating their national currencies to worthlessness for short-term political gains, as the United States has been doing for many decades!

Look at the chart above. One either understands that rising gold and silver prices are baked into the cake for years to come, or they’re idiots. I don’t mean to offend anyone who disagrees with me, but this chart makes clear that Washington is killing the dollar, and it’s actually sad how few people understand this, and the implication this data’s has for the future price of gold and silver.

Had the US Government maintained their Currency in Circulation at its 1925 level of $3.96 billion paper dollars in circulation, the amount that $3.96 billion of gold reserves held by the US Treasury would allow in an honest gold standard; an ounce of gold today would still be priced at $20.67. If gold today is now over $1650, it’s only because Washington has inflicted the banking system’s management with inflationary-buffoons like Alan Greenspan and Doctor Bernanke.

So, to those of us who understand the market’s malaise for what it really is; central banks doing what their political masters demand of them, we’ll pass on Jim Cramer’s bank stocks, and hold on to our gold and silver no matter what Dennis Gartman would have us do.

Mark J. Lundeen Mlundeen2@Comcast.net 04 January 2013

|